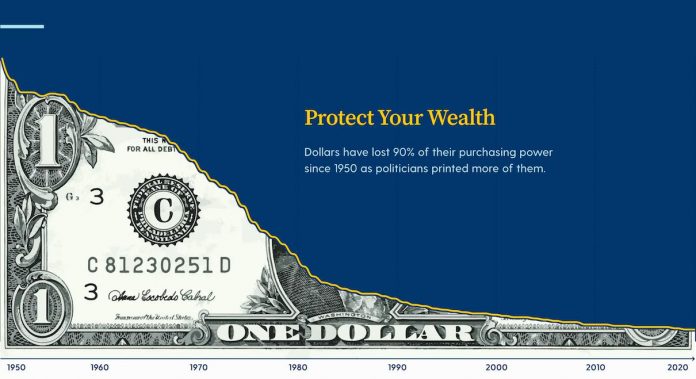

These days, world-wide news outlets paint a vivid picture of an ever-increasing global economic meltdown, as the value of the dollar keeps going down every year and has gone down 90% since the 1950s, and especially during this terrible global COVID-19 Pandemic, which is expected to get worst and go well into next year or even 2022! Understandably, this world-wide economic downturn has led to tremendous concern throughout the investment community.

Traditional investments no longer provide the reliability and security necessary to withstand the current and mounting economic deterioration that is sweeping the globe. Many believe the time is now to secure your financial future with Gold and other Precious Metals in order to truly diversify and protect your investment portfolio.

Throughout time, Gold and Silver has provided privacy and liquidity with consistent, profitable returns. It is known to be amongst the safest asset classes available in the market to protect and increase your hard earned personal wealth. Gold is recognized internationally as a conservative asset that continues to increase in value despite temperamental stock market conditions and a volatile global economic landscape.

Overtime in the long run Gold & Silver Coins, and Bullion have always gone up in value and price, which makes these Precious Metals the safest and best investments you can find- even better than real estate!

In fact you can even invest with no additional money out of your own pocket! You can just transfer or rollover funds from your own current IRA or 401k account to add gold or silver to your portfolio! Read below for more details.

In you are looking for some great advice: Bank of America says that “Gold will go up to $3,000 an ounce, and silver will go up to $50 an ounce!” Read below for more details.

Saving for retirement and preserving it, is an absolute necessity for your happiness in your golden years. Planning ahead for any incidents, whether stock market crashes, inflation, geopolitical uncertainty and now, a global pandemic, is a must-have part of your planning process. By adding gold and other precious metals you can add diversification and preservation to your retirement landscape, helping sail the rough seas that are sure to come your way.

Bank of America Corp. raised its 18-month gold-price target to $3,000 an ounce — more than 50% above the existing price record, and silver will reach $50 an ounce — in a report titled “The Fed can’t print gold.”

The bank increased its target from $2,000 previously, as policy makers across the globe unleash vast amounts of fiscal and monetary stimulus to help shore up economies hurt by the coronavirus.

“As economic output contracts sharply, fiscal outlays surge, and central bank balance sheets double, fiat currencies could come under pressure,” analysts including Michael Widmer and Francisco Blanch said in the report. “Investors will aim for gold.”

WHY PRECIOUS METALS?

There are many benefits to owning gold. Adding a gold factor to your portfolio can considerably reduce your overall portfolio volatility, create a hedge against economic downturn, and add a enormous prospect for gain.

For an investors planning for retirement, whether you are considering investing in gold for a more a long-term investment, buying gold into a self-directed IRA can help protect your assets and can increase returns. Having a modest amount of gold and silver within a balanced retirement investment portfolio can potentially reduce the overall risk of the portfolio, helping to protect against downturns in the markets.

WHAT IS A PRECIOUS METALS IRA?

A precious metals IRA is just like your traditional Individual Retirement Account (IRA), it is simply comprised of physical gold, or other IRS approved precious metals (such as silver, platinum, and palladium). A custodian, which is approved by the IRS, will hold in custody the contents of the Precious Metals IRA for your benefit, the account owner. A Precious Metals IRA will act in the same manner as the traditional IRA, but rather than holding paper assets, you are actually holding the underlying hard asset in your IRA, physical bullion coins or bars.

Since gold is the most common precious metal invested into Precious Metals IRA, the term Gold IRA has been used widely in the industry to refer to a retirement account containing any combination of IRA approved precious metals.

THREE WAYS TO FUND

YOUR PRECIOUS METALS IRA

1. Direct Transfer

The individual account holder instructs that money be transferred directly from their current IRA trustee into a new IRA account. Money moves from one company (trustee) to another company (trustee) without the account holder having to take receipt of funds at any time. This type of transfer is 100% tax-free, IRS penalty-free and has no restrictions on the amount of transfers available.

2. Rollover

Money can be withdrawn from one retirement plan and contributed to another IRA within 60 days of the initial withdrawal. This transaction is 100% tax-free and penalty free. Money is sent from an old retirement plan directly to the individual account holder and they are responsible for contributing it to their new IRA within 60 days to avoid paying taxes. This is the most commonly used method for people with employer-sponsored retirement plans (401k, 403b, 457b). Generally, this can only be done one time per year, per account.

3. Contribution

The 2020 combined annual contribution limit for Roth and traditional IRAs is $6,000 ($7,000 if you’re age 50 or older)—these amounts are unchanged from 2019.

This applies to Traditional & Roth IRA accounts only. Owners of SEP IRA’s can contribute either 25% of earned income or $57,000 per year, whichever is less. Exceptions apply.

POPULAR IRA APPROVED COINS

Gold, silver, platinum, and palladium coins and bars are held in a Self-Directed IRA. However, by IRS standards, they must be brand new, uncirculated, and meet a specific minimum purity level (otherwise considered investment grade).

- Minimum gold fineness: .995

- Minimum silver fineness: .999

- Minimum platinum fineness: .9995

- Minimum palladium fineness: .9995

Any precious metal product falling outside of these levels, with the exception of the American Gold Eagle coin, is not IRA permissible. For the exact composition of metal and the form of metal (bars or coins), please call to speak with a precious metals specialist today.

With the Taxpayer Relief Act of 1997, the IRS rules for a Gold IRA were set. The IRS approved only a select few precious metals and forms of bullion able to be invested into a precious metal IRA. The four approved precious metals are gold, silver, platinum, and palladium and have to be in the form of bullion, coins, bars, and rounds. Also, the IRS issued requirements of fineness of the precious metal products.

For your consideration, we have provided a list of IRS approved precious metal bullion, coins and bars below. As it pertains to physical storage of your precious metals for your Gold IRA, the precious metal products must be in the possession of an IRS approved custodian or trustee, not the IRA owner. In regards to receiving a distribution, the laws for taking distributions from a Gold IRA are the same as those for a regular IRA. You may liquidate your IRA metals for cash or take physical possession of them, however, either is considered an IRA distribution and will be taxed accordingly.

IRS Approved Gold Products

- American Gold Eagle bullion coins

- American Gold Eagle proof coins

- American Gold Buffalo coins

- Canadian Gold Maple Leaf coins

- Great Britain Gold Rose Crown coins

- Canadian Gold Wildlife Portrait Series bullion coins

- Austrian Gold Philharmonic coins

- Australian Gold Kangaroo coins

- American Gold Buffalo uncirculated coins (proofs not allowed)

- Gold bars and rounds produced by a NYMEX or COMEX-approved refinery or national government mint, meeting minimum IRS fineness requirements

- Below Photos of 4 Popular Gold Coins:

- Above Photos of 4 Popular Silver Coins:

IRS Approved Silver Products

- American Silver Eagle bullion coins

- American Silver Eagle proof coins

- Canadian Silver Maple Leaf coins

- Great Britain Silver Rose Crown coins

- Canadian Silver Wildlife Portrait Series bullion coins

- Austrian Silver Philharmonic coins

- Australian Silver Kangaroo coins

- Silver bars and rounds produced by a NYMEX or COMEX-approved refinery or national government mint, meeting minimum IRS fineness requirements

IRS Approved Platinum Products

- American Platinum Eagle coins

- American Platinum Eagle proof coins

- Canadian Platinum Maple Leaf coins

- Australian Platinum Kangaroo coins

- Platinum bars and rounds produced by a NYMEX or COMEX-approved refinery or national government mint, meeting minimum fineness requirement

- Below Photos of 3 Popular Platinum Coins:

- Above Photos of 3 Popular Palladium Coins:

IRS Approved Palladium Products

- American Eagle Palladium coins

- Canadian Palladium Maple Leaf coins

- Palladium bars and rounds produced by a NYMEX or COMEX-approved refinery or national government mint, meeting minimum fineness requirements

ARE YOU PROPERLY DIVERSIFIED?

Tragically, the structural problems behind the 2008 financial crisis were never solved. Debt and exotic derivatives still provide the unstable foundation upon which the modern financial system is built. Dollars and dollar-denominated assets carry massive counterparty risk, and fiat currencies such as the U.S. dollar are infamous for losing value or even collapsing entirely once confidence is lost.

Dollar-denominated assets such as stocks, bonds, mutual funds, and ETFs come highly recommended by financial advisors and stockbrokers for two reasons.

As a matter of self-preservation, most financial professionals have embraced the prevailing economic narratives as sound and sustainable. Not surprisingly, many of these professional bankers and advisors are not ready or willing to acknowledge the profound changes in the economic landscapes – both domestically and globally. They refuse to recognize the fast approaching endgame of dominance and reserve status for the once “Mighty Dollar.”

These professionals represent the sales and marketing arm of Wall Street, and they make their living selling paper assets, for which they collect big commissions and command hefty fees. Bankers and Politicians don’t want to talk about hard-assets like physical gold and silver, because they have no direct incentive to do so. Additionally, they don’t want people to know gold and silver represents a smarter way to save. They would prefer everyone to remain inside the system they have built – paying fees, sacrificing privacy, and backstopping their mistakes with taxpayer-funded bailouts..

- Stay tuned for live daily round-the-clock news coverage from our news team in Los Angeles, Hollywood, New York, Beverly Hills, and overseas from Entertainment & Sports Today TV, and Entertainment Today, and for the complete story go to: entertainmentandsportstoday.com, on Facebook & Instagram: @entertainmentandsportstoday, and Youtube.com/entertainmenttodaytv

- For tickets to future events, and Sponsorships and get advertising rates and info, E-Mail : info@entertainmentandsportstoday.com – and for more info about us go to: www.entertainmentandsportstoday.com & thanks for watching !

- For more information, and if you like to buy any of these great products that you saw on our TV show, E-Mail us direct: info@entertainmentandsportstoday.com so that one of our staff can connect you with the right people. Above is our video news story, that is part of the follow up to our daily news stories on the Coronavirus.

- For more news stories and updates about the Coronavirus : go to EntertainmentandSportsToday.com and go to the top of the home page and click on the “HEALTH & BEAUTY” section. Additional updates can be found by clicking the “Business & Technologies” , and “Entertainment” sections, or just click “Home”. For stories that may uplift your spirits during these trying times go to the “Music” section of our website.

- If you may have any questions- you can email us at info@entertainmentandsportstoday.com- so we can find you the answers from the doctors and health experts, that have written stories for us, and from the health agencies that have provided information and daily updates for us. & Thanks for watching, and be healthy and safe!